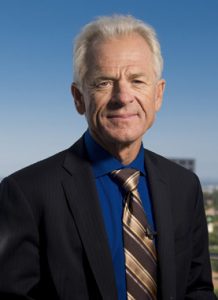

President Trump’s protectionist trade adviser Peter Navarro

Correspondent L.C.’s weekly trade report which follows is likely the most comprehensive such report available on the internet without charge to readers.

Beyond the tariffs President Trump is imposing on steel and aluminum and intends to impose on Chinese exports, the US press reports that he is serious about wanting to rearrange US trade relationships so that the US can impose tariffs that are reciprocal product-by-product and country-by-country. That would destroy the World Trade Organization (WTO), which is based on countries committing to tariff levels applied on a most-favored nation (MFN) basis, that is, a country applies the same tariff to imports of the same product from all trading partners.

[There are several WTO-approved exceptions to this basic principle, namely antidumping and safeguard duties and the lower tariffs permitted within free trade agreements (FTAs).]

It appears from these reports that the President’s recent strident and inaccurate denunciations of the WTO may have sprung from his frustration with being told that the WTO is an obstacle to the US demanding reciprocal tariffs from trading partners. He has also been told that he has no authority to make this demand on his own.

New this week are reports that he therefore wants to have Congress pass legislation that would authorize him, as a CNBC reporter said, “to impose reciprocal tariffs country by country and product by product. The President has talked about this publicly, but some in the White House want a bipartisan bill.”

Axios has just reported the same information. The President, it writes, “wants Congress to pass a bill to let him raise tariffs to reciprocal levels, according to three sources with direct knowledge.” One source added that he wants the power to use it as leverage to get other countries to lower their tariffs rather than use it to raise US tariffs. But just passing such a bill, as Axios put it, “would effectively break the WTO.” Engaging in mutual tariff-cutting is what free trade agreements, which the President dislikes, are about. Though the US runs trade surpluses with most of its FTA partners, mutual tariff cutting is not a way to lower the trade imbalance, which is the President’s stated trade policy priority.

Trump’s legislative affairs advisers reportedly told him such legislation wouldn’t pass. But with Gary Cohn and other pro-trade figures having left the White House and trade adviser Peter Navarro elevated to more influence, the President may try to push this idea. (As Axios points out, it is unknown how much of a free trade champion Larry Kudlow – see below – will be from his new position advising Trump.)

It is possible that such legislation could get some Democratic support. Although the Democratic Party base is turning much more pro-free trade than in the past, the leadership has apparently decided it is politically wise for them to criticize the President for being too weak on trade. Republican support for a reciprocity bill is highly unlikely apart from a few legislators who are solidly in Trump’s camp on everything, but the President could make a play for Democrats. Still, that wouldn’t get a bill passed, or even get it to move in either chamber if the leadership is opposed.

It should also be noted that if the President were to try to push his idea on Capitol Hill, it might so alarm pro-trade Republicans that it would give momentum to the pending bills aimed at restraining presidential trade action, bills that otherwise don’t appear likely to move.

Amid confusion, Section 232 tariffs are about to be launched

The Section 232 tariffs of 25% on steel and 10% on aluminum are set to take effect on March 23rd. Getting to that point continues to be chaotic. The Administration wasn’t sufficiently prepared for the move when President Trump announced the tariffs in early March.

US Trade Representative (USTR) Robert Lighthizer

In particular, the processes for granting country exemptions – to be determined by the US Trade Representative (USTR) – and product exclusions – to be determined by the Commerce Department – are only just being clarified, and there remains much confusion. Moreover, despite the procedures for applying for and granting these exceptions, the President will make the final decision.

The Commerce Department announced that on March 19th it will begin accepting petitions for products to be excluded from the tariffs. Of the 4,500 (!) exclusion requests Commerce said it is anticipating, it said it expects challenges to about 1,500 of them.

There are calls from Congress and the private sector to include a rule making tariff exclusions retroactive, so that once an exclusion is granted, tariffs already paid would be returned to the importer.

Commerce explained the basic criterion for exclusion: “An exclusion will only be granted if an article is not produced in the US in a sufficient and reasonably available amount, is not produced in the US in a satisfactory quality, or for a specific national security consideration.”

But Commerce should have looked at availability of products before proposing the tariffs.

Commerce officials reportedly let the business community know that it does not intend to grant many exclusions and will be looking for a national security need for those it does grant.

Just what will win a country exemption is even less clear. There are five basic criteria: whether a country actively supports international measures against China’s metals excess capacity, whether a country uses trade defense measures (unfair trade duties) that would keep dumped steel out of its products, whether a country has supported the US in WTO cases it brought against other countries’ unfair use of unfair trade duties, what a country’s trade in metals has been with the US, and whether the country is a security partner. These, especially the last, are quite subjective, though the USTR will provide more detail.

The situation has led to intensive lobbying by trading partners to convince the US they deserve an exemption. Many foreign officials passed through Washington this week to make their case, and will lobby US officials at the March 19th G20 finance ministers meeting. One problem the Administration has set for itself is that some countries will find that Washington has determined they are not security partners, with unknown implications beyond trade. That is, how should Japan, South Korea, or the EU — or for that matter, Brazil or Hong Kong — respond if they find the US does not appear to value them strategically? (Note that the US even has a trade surplus with Brazil and Hong Kong.)

Still unclear is the status of the Commerce recommendation that tariff relief granted an exempted country must be compensated for by further raising the tariff on the remaining countries. If the recommendation is followed, it means that significant tariff hikes beyond the 25% and 10% levels must be made just because of the two exemptions already granted to Canada and Mexico. But if the recommendation isn’t accepted, then the Commerce analysis of what has to be done to protect domestic metal industries for national security purposes would appear to be frivolous, and that would make it difficult for the US to defend the tariffs at the WTO or in domestic courts.

Almost all the major metals suppliers are allies — some, like Japan and the EU, actually part of military alliances. But if they are all exempted, there won’t be any significant tariffs at all.

The EU has already said that if it is not exempted, it will seek compensation at the WTO by claiming the tariffs really have the form of safeguards, since US officials cite injury to domestic industries from rising imports. The US may not be able to prove the tariffs fit WTO criteria for safeguards, and so the EU may be authorized to get compensation. EU officials also suggested that rather than imposing tariffs on metals and threatening them on autos, the US and EU should revive talks for the Trans-Atlantic Trade & Investment Partnership.

But Brussels also unveiled a long list of potential retaliation targets and began accepting public comments, suggesting retaliation would be in the amount of about $3.5 billion. The EU is among the most vocal and active countries demanding an exemption and warning it must get it. Among its arguments is that it is already cooperating with Washington against China’s overcapacity.

Tokyo can also make the case that it meets the criterion of acting against China’s overcapacity as well as being a strategic partner — using its own AD/CVD (anti-dumping/countervailing duty) laws aggressively and supporting the US at the WTO, so that it is meeting US criteria at least as well as the EU does.

A weak legal case — and price rises

Lawyers continued to warn this week that statements and tweets by the President and Administration officials that linked the granting of exclusions to matters other than national security – as do the criteria suggested this week for country exclusions – have already made legal defense of the tariffs much more difficult. At least, that would be the case if the US chooses to defend the tariffs at the WTO by citing the WTO’s Article XXI national security exemption.

Aluminum sheets and ingots

Another ramification of the tariffs is already being felt. US companies that import or use metals report that the uncertainty over the situation has caused a chaotic environment and significant business losses, with steel and aluminum prices rising rapidly. This is especially the case for smaller manufacturers, some of whom have already begun laying off workers. Others report they may go out of business or move factories off-shore where inputs will be tariff-free. Moreover, the uncertainty about foreign retaliation has already caused some exporting companies to lose business, while US agriculture is bracing for major losses. This is hardly a consequence wanted by the Administration, but it is certainly one that congressional Republicans and the private sector have warned about.

In light of this, some expect that US companies will quickly go to court seeking a temporary injunction — arguing the tariffs are illegal because they are imposed for reasons other than national security, as shown by officials’ statements. While lawsuits can’t be filed until the tariffs take effect, a number of businesses have already written the Administration demanding the tariffs not be imposed on them, even before they apply for exclusions. These businesses include those dependent on aluminum cans and, more significantly for the Administration, the energy industry, warning that foreign steel and tubular goods are needed for the development of pipelines. Reportedly, one consequence of the tariffs is that South Korean producers of oil-country tubular goods are already seeking markets other than the US, which could squeeze supplies for US energy companies.

Abroad, it is expected that countries not in trade agreements with the US will be more reluctant to enter negotiations with Washington. This was clear previously, but this week several former US trade officials highlighted the risk posed by the Section 232 tariffs to future trade negotiations.

Will there be a Kudlow influence?

Larry Kudlow, President Trump’s new National Economic Council (NEC) director

President Trump announced on March 13th that he has chosen Larry Kudlow to replace Gary Cohn as Director of the White House National Economic Council.

Kudlow endorsed Trump very early in his campaign, well before he won the Republican nomination, and has continued to use his media appearances to express enthusiastic support for most of Trump’s policies – though not his trade protectionism. Kudlow played a role in shaping and then touting the recent tax reform legislation. By all accounts, the President likes Kudlow personally and is appreciative of his publicly expressed support, telling reporters this week, “I think he was one of my original backers.”

Ironically, the one policy on which Kudlow continues to differ with the President – trade – is the one that forced Cohn to depart. An opponent of the universal Section 232 tariffs, Cohn left after they were announced.

Kudlow, who supports NAFTA and supported the Trans-Pacific Partnership (TPP), was immediately critical when the steel and aluminum tariffs were unveiled. When asked about these differences, the President said, “We don’t agree on everything. I want a divergent opinion. He now has come around to believing in tariffs as also a negotiating point.” Presumably this means that Kudlow told the President he now believes that tariffs could be used for leverage in trade negotiations.

Kudlow explained, “I don’t like blanket tariffs and I don’t think you should punish your friends to try and punish your enemies in international affairs,” but then softened his criticism of the 232 tariffs when the Canada and Mexico exemptions were announced, along with a process for exempting other trading partners. The problem, of course, is that if you exempt friendly countries, you have almost no countries left that can be hit with the tariffs, as the top steel suppliers to the US are all friendlies.

Kudlow spelled out his own opinion on the tariff issue in interviews this week. In addition to a statement against “blanket tariffs,” he said, “I must say as somebody who doesn’t like tariffs, I think China has earned a tough response not only from the US. A thought that I have is the US could lead a coalition of large trading partners and allies against China, or to let China know that they’re breaking the rules left and right. That’s the way I’d like to see. You call it a sort of a trade coalition of the willing.”

Those remarks earned Kudlow some ridicule as others pointed out that a “coalition of the willing” that could face off with China is precisely what the TPP was crafted to be, and that it is the Trump Administration that, by announcing the 232 tariffs, has disrupted efforts by trading partners to coordinate a tough response against China. Moreover, the only institution where such a “coalition” could effectively take on China is the WTO, which is currently being attacked and undermined by the Trump Administration.

Click here to go to the previous Founders Broadsheet post (“Europe’s troubles, Putin’s hope, a justifiable Trump tariff intervention”)

Leave a Reply