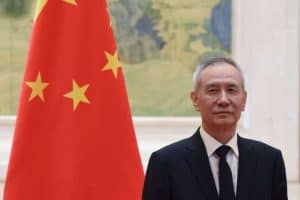

Lead Chinese trade negotiator and the country’s vice-premier, Liu He

Trade correspondent L.C. reports: The US and China have announced the unleashing of the next tranche in tit-for-tat tariffs, covering $16 billion in each country’s exports, to begin on August 23rd. The US tariffs are set at 25% and are being imposed under trade law Section 301. The Chinese tariff rate will also be 25%. The final US list contains 279 different products and is heavy on chemicals, wood, and electronic parts. It provoked an immediate protest from the US semiconductor industry, which says that raising the cost of the listed imports will hurt it more than the Chinese.

The release of the list also prompted major industry groups such as the National Association of Manufacturers and National Retail Federation (NRF) to again issue sharply worded statements criticizing the whole process of determining and imposing tariffs. According to the NRF, the tariffs bring a huge risk “with no endgame in sight,” so “It’s time to stop digging a deeper hole while we can still climb out.” President Trump, however, believes that the tariffs are “working big time.”

International corporations are reportedly seeking to shift supply chains so that final assembly doesn’t take place in China, allowing products to be officially exported from countries not hit with the Section 301 tariffs. That could even lead to a lowering of the US-China trade imbalance, but it would just mean that the surplus with the US gets shifted to other countries. Nevertheless, a negotiated settlement remains possible. Some of the Chinese elite have begun questioning President Xi Jinping’s leadership, including his management of trade relations with the US, which he is accused of needlessly inflaming. On the other hand, China’s lead trade negotiator Liu He has just been given increased powers in the government and is regarded as President Xi Jinping’s right-hand man.

A third tariff tranche is being readied

With the US preparing for a third tranche – a list of Chinese exports worth $200 billion to be hit with tariffs of either 10% or 25% — China too is preparing its next hit list of US exports. However, given that the US sells well under $200 billion in goods to China each year, Beijing is preparing to hit different goods with different tariff levels, aiming as much as possible to spare imports for which China doesn’t have good alternative suppliers. The US tariffs of $200 billion may be imposed any time after September 6th, the closing date for public comments on them.

Although China doesn’t have a matching $200 billion in imports from the US on which it could impose tariffs, there are other ways it can punish the US commercially. This week brought reports that it is subjecting US investments to enhanced scrutiny, a practice that could ensnare major buyout proposals that, even if not based in China, would still need approval of Chinese authorities. This is not a small matter as the transactions in question include Disney’s bid for part of 21st Century Fox and United Technologies acquisition of Rockwell Collins. China already blocked Qualcomm’s acquisition of NXP Semiconducters.

Commerce Secretary Wilbur Ross under attack

Secretary of Commerce Wilbur Ross, the grifter?

Commerce Secretary Wilbur Ross came under a new attack this week when Forbes magazine published an article portraying him as an unprincipled grifter, detailing a pattern of cheating on business associates and amassing his fortune through improper methods. These accusations are different from, but obviously compound, the recent disclosure that Ross was reprimanded by the Office of Government Ethics for violating regulations in not divesting some assets when he assumed office. They are also different from the previous Forbes disclosure that Ross had lied about his wealth in order to be placed on the magazine’s list of billionaires. Some Democrats in Congress have begun to call for serious investigations, but it is unlikely the President would seek Ross’s resignation since it would be difficult to get a new Commerce Secretary confirmed, and Ross has been strongly defending the President’s trade policies.

First US-EU Executive Working Group meeting set

The US-EU Executive Working Group (EWG) that President Trump and European Commission President Jean-Claude Juncker agreed to set up at their July 25th summit will hold its first meeting on August 20th, the two sides announced this week. Reportedly, additional meetings are already being planned.

This first get-together is considered a “scoping exercise” to determine just what the talks might cover, but there are also reports that it might come up with some “deliverables,” in particular details of how the EU plans to increase imports of US LNG and soybeans, key items discussed by Trump and Juncker. Scoping would seem to be particular important given that the two sides continue to dispute whether agriculture is to be included in the discussions, the US insisting it is and the EU rejecting the idea. Many facets of farm trade were among the most difficult issues in suspended talks for the US-EU Trans-Atlantic Trade & Investment Partnership.

Few observers believe that issues beyond gas and soybeans will see fast movement in the new process, since there have been no new developments easing the stumbling blocks that caused the TTIP talks to be “frozen” before President Trump took office. Moreover, the EU has since consolidated more free trade agreements (FTAs) including with Canada, Japan, Mexico (updated), and Singapore (being ratified) — and is in talks with MERCOSUR, Australia, New Zealand, and ASEAN.

US threat to Japanese car exports remains

US Trade Representative Lighthizer and Japanese Economy Minister Toshimitsu Motegi held the first meeting of the new US-Japan high-level framework for working toward “free, fair, and reciprocal trade.” Although nothing was accomplished in these preliminary meetings, continuing dialogue is important since Japan is under a continuing threat that the US might impose tariffs on its automotive exports, try to force it to accept voluntary export quotas on metals exports, push Tokyo to pressure its auto companies to invest even more than now in US factories, or take other unilateral actions in an effort to close the bilateral trade imbalance.

A satisfactory outcome would be if the US accepts a promise that Japan will work to boost imports from the US, perhaps focused on LNG and military equipment which Japan wishes to purchase anyway — in exchange for relieving the above-mentioned pressures and an agreement to continue talking about further trade liberalization. Even better, from Tokyo’s standpoint, would be a US decision to come back into the Trans-Pacific Partnership. But that is not on the near-term agenda. Outside of an FTA, Japan can’t reduce its tariffs on farm and meat products. That is because its tariffs have to stay at Most Favored Nation levels. Already, there were reports before the meeting that the US refused to put the auto Section 232 tariffs on the table – that is, it refused to cut a deal like it recently gave the EU, which included the promise of no auto tariffs.

Turkey hit with doubled Section 232 tariffs

President Trump announced in a tweet early on September 10th that he has authorized the doubling of the Section 232 tariffs imposed on Turkey to 50% for steel and 20% for aluminum. Ankara quickly responded with a threat to complain to the WTO. Ankara may have a particularly good case for arguing that the US appeal to the WTO’s national security exception is spurious given that the President’s tweet gave a different reason. Actions taken under Section 232 authority are supposed to be directly aimed at a particular security threat posed by imports.

NAFTA: Endgame still not in sight

A third week of US-Mexico minister-level talks led to reports of progress but also the emergence of sticking points that may make it impossible to reach a deal by month’s end. That is the deadline if NAFTA 2.0 is to be signed by the current Mexican government, before President-elect Andres Manuel Lopez Obrador (“AMLO”) takes office. Current President Enrique Peña Nieto would like to sign the deal that has been negotiated by his administration, and AMLO very much wants the NAFTA problem out of the way before he takes office so he can focus on his domestic reform agenda.

Click here to go to the previous Founders Broadsheet (“Indexing capital gains taxes a good idea, but…”)

Leave a Reply