John Greenwood and Steve H. Hanke have written (Wall Street Journal, June 5, 2019) what may be the definitive refutation of Modern Monetary Theory . MMT, the two authors explain, holds that “fiscal deficits don’t matter as long as countries borrow in their own currencies and inflation stays in check.”

MMT is currently being promoted by some elected Democrats, such as Alexandra Ocasio-Cortez, to allay concern with the huge cost of the Green New Deal — up to 93 trillion dollars.

In debunking MMT, the two authors disentangle money from credit – a discrimination the public and even economists often get wrong. In so doing, they revive classical, as opposed to modern, monetary theory.

MMT’s Japan paradigm isn’t

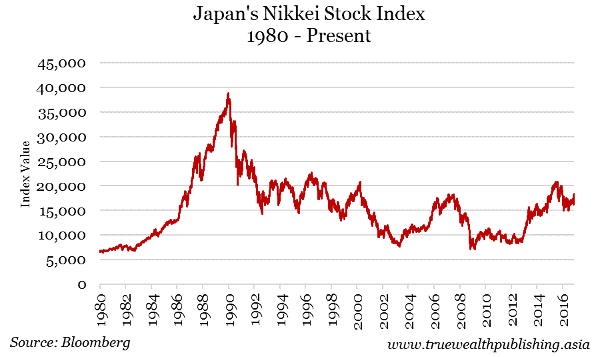

MMT proponents cite Japan as their exemplar of a nation whose government has taken on a huge amount of debt without triggering inflation. Japan, however, after decades of economic stagnation accompanied by a huge government debt (now 200% of GDP), is hardly a paradigm of economic growth.

Greenwood and Hanke write:

“As long as M2 growth in Japan remains minimal, low inflation—or outright deflation—will prevail regardless of whether the public and private sectors are running savings surpluses or deficits. As Milton Friedman counseled, ‘Inflation is always and everywhere a monetary phenomenon.’ The same is true of deflation. Money dominates.

“Understanding Japan and other economies requires classical monetary theory, not MMT nostrums. From 1974-84, Japan enjoyed a golden period with generally stable broad-money growth, steady real GDP growth, and low inflation. Then monetary policy was derailed by the 1985 Plaza Accord and the 1987 Louvre Accord. The Bank of Japan dropped monetary targets and began to focus on interest-rate targets. The result was Japan’s disastrous bubble from 1987-90, followed by a so-called lost decade, which has turned into a lost generation.

“According to the Bank of Japan, the basic idea of interest-rate targeting is that if interest rates can be pushed low enough, sooner or later companies or households will start spending. But as Irving Fisher showed a century ago, interest rates follow inflation; they don’t precede it. That is why economies experiencing high rates of inflation, like Argentina and Turkey, have high interest rates, while Japan and the eurozone have very low or even negative rates.

“For Japan (and the eurozone), this circle can be broken only by increasing broad-money growth.”

US vindicates classical monetary theory

The authors continue:

“Recent US history also demonstrates the superior explanatory power of classical monetary theory. From 1971-82, M3 money-supply growth averaged 11.6% a year, while the average level of government debt was only 40.1% of GDP. This combination of rapid monetary growth and low government debt resulted in relatively high inflation. Money dominated.

“Today the U.S. faces the opposite: low broad-money growth with high government debt. Since 2009, M3 growth has averaged 4.5% a year, while federal, state and local government debt today is more than 100% of GDP. This combination has resulted in relatively low inflation. This is no mystery. As always, money dominates.

“MMT advocates would have us believe that governments can run deficits without limit as long as they are financed by securities denominated in their own currencies—at least until inflation takes off. What they fail to understand is that budget deficits have nothing to do with inflation, unless they are financed by rapid broad-money growth.”

If MMT proponents try to reduce their enlarged deficit by printing too much money, inflation will break out. If they don’t reduce the deficit but just let it grow and grow, they will get a government debt bubble like Greece did over a decade ago. Economic disaster will be the result of either scenario.

Leave a Reply