by Richard Schulman

Progressives are proposing four new taxes to finance their costly spending plans and to supposedly reduce inequality:

- A wealth tax (Senator Elizabeth Warren [D-MA]);

- An accelerated (Senator Ron Wyden [D-OR] or increased (former Vice-President Joe Biden) capital gains tax;

- A financial transaction tax (Representative Peter DeFazio [D-OR] and Senator Brian Schatz [D-HI]); and

- A gross receipts (turnover) tax (Oregon Democrats).

What the four plans have in common is that they all seek to raise funds for government by repeatedly soaking the rich or business and promising to spend the money on a pot pourri of benefits for the non-rich. This approach is in stark contrast with the Republican-passed 2017 Tax Cuts and Jobs Act, which sought to promote prosperity for all classes by increasing incentives for investment and growth.

Wealth tax

Senator Warren wants to assess a 2 percent wealth tax on Americans with assets above $50 million and a 3 percent wealth tax on those with more than $1 billion. “Ms. Warren…draws cheers at campaign events when she mentions the tax,” the Wall Street Journal reports. Although local property taxes are a familiar form of limited wealth tax, to levy a federal tax on all wealth would have at least three drawbacks: first, it would be hard to enforce, because some forms of property are illiquid, hard to price at a given point in time, and / or easily concealed from the tax inspector; secondly, it would provide a huge incentive for spectacularly wasteful consumption rather than being invested in new technology, jobs, and growth; and third, it would provide an incentive for switching citizenship to another country, as happened in Europe when such taxes were attempted (and, not surprisingly, subsequently abandoned).

Accelerated or increased capital gains taxes

Ron Wyden wants to accelerate the collection of capital gains taxes by having unrealized capital gains taxes payable every year — even if the property being taxed is producing no income. As in the case of a wealth tax this would be easy to do for stocks and bonds that have a daily market but difficult for those forms of wealth for which no regular market exists.

Joe Biden wants to increase capital gains income to the government in two ways: by hiking the capital gains tax to 40% for taxpayers with incomes of more than $1 million and by abolishing the stepped-up basis that assets receive when they are inherited.

Neither Democrat favors inflation-indexing of capital gains, a proposal favored with justification by many Republicans. It’s unfair to pay tax dollars for a spurious increase in sale price caused by the government’s inflation of its fiat legal tender. More fundamentally, capital gains taxes of investments at the individual level should be done away altogether for two reasons: 1) because they incentivize taxpayers to hold on to unproductive investments to avoid taxation. This undercuts economic growth; 2) because capital gains taxes are double taxation of the same income. Here is Hall and Rabushka’s explanation (from The Flat Tax in 1995):

[C]onsider the common stock of a corporation. The market value of the stock is the capitalization of its future earnings. Because the owner of the stock will receive their earnings after the corporation has paid the business tax, the market capitalizes after-tax earnings. A capital gain occurs when the market perceives that prospective after-tax earnings have risen. When the higher earnings materialize in the future, they will be correspondingly taxed….With taxation at the source [i.e., the corporate level], it is inappropriate and inefficient to tax capital gains as they occur at the destination [the individual taxpayer].

Thus, Wyden and Biden’s tax proposals are making a bad feature of the present system — double taxation of capital gains — even worse than it already is. Hong Kong has no capital gains tax, and that is one of the reasons for its prosperity.

The financial transaction tax

The financial transaction tax (“Wall Street Tax Act”) being proposed by Representative DeFazio Senator Schatz would levy a financial transactions tax of 0.1 percent on stocks, bonds, and derivatives. If an investor sells one stock and uses the funds freed up to buy four other stocks, what was in effect one trade would now incur five transaction taxes — quintuple taxation of a single trade. Arbitragers trade many stocks rapidly. In so doing, they keep markets liquid and buy/sell spreads within a narrow range. A transaction tax would severely hamper such activity. The Tax Foundation reports:

Sweden’s imposition of a financial transactions tax in the 1980s illustrates the challenges perfectly. The country experienced a 60 percent decrease in trading volume as it moved to other markets, as well as a decrease in revenue.

Gross receipts tax

Five states levy gross receipts tax, Democratic Party-controlled Oregon being the latest addition. The tax is levied at every stage of production. This results in a cascade of taxes on every firm involved in the supply of a good — raw material suppliers, intermediate processors, shippers, retailer, etc., taxes all passed on at the end to the consumer. It encourages inefficient and uneconomic vertical integration to avoid multiple taxation in the production of a single good. The tax is levied on businesses irrespective of whether they are showing a profit. For this reason, it provides a strong disincentive to new business formation. “[E]conomists all across the political spectrum agree that a gross receipts tax is among the most economically damaging ways to raise revenue,” Forbes writes.

Why do they do it?

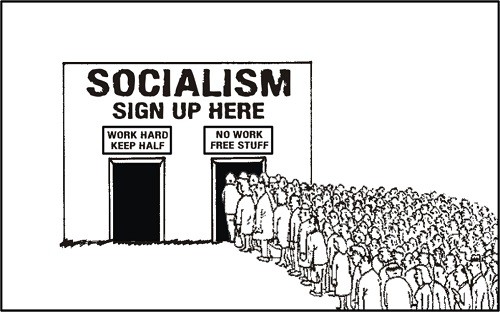

Progressives’ sponsorship of a wealth tax, unfavorable treatment of capital gains, the Wall Street Tax Act, and the gross receipts tax all have a common denominator: soaking the rich or their business surrogates. They not only ignore incentives for fostering economic growth; they adopt policies that will harm it and create unemployment among the workers they purport to represent. The apparent psychological motivation behind this strange behavior is the politics of envy — to reduce inequality by pulling the rich down from their heights rather than promoting prosperity for all classes with policies favorable to growth.

Something similar is happening in New York City under the leadership of Progressive icon, Mayor Bill de Blasio. The mayor is upset at the huge distance separating the city’s many wretched public schools from the minority of functioning-to-excellent magnet and elite schools. His solution: pull down the functioning-to-excellent schools to the level of the wretched schools. Progressives, with their social base of aggrieved identity groups, prefer leveling down — the politics of envy — to the republican ideal of policies to help all to rise up.

Hat tips: Dan Mitchell, the Tax Foundation here and here, and Forbes. See also our earlier comments on Hall-Rabushka.

Leave a Reply