by Trade Correspondent L.C.

In this odd week for US-China ties, President Donald Trump formally accused Beijing of being a currency manipulator while also calling for the US to manipulate the dollar lower. This raises the question of whether the Trump Administration will directly intervene in the currency markets to devalue the dollar. That’s something the president has already suggested he is considering and that trade adviser Peter Navarro threatened in a TV interview.

In line with his unhappiness with the high dollar, the president again this week went after the Federal Reserve. He wants lower interest rates because he thinks that will boost the economy and help push the dollar lower. On August 7th he tweeted “Our problem is not China. Our problem is that Federal Reserve that is too proud to admit their mistake…. They must Cut Rates bigger and faster, and stop their ridiculous quantitative tightening NOW…. we are competing against other countries, all of whom want to do well at our expense!” This week’s developments make it much more likely than it had appeared before that there will be at least two more Fed cuts this year.

The US also tightened restrictions on Chinese tech companies while casting doubt whether scheduled trade talks with Beijing will occur. This makes it more likely that the remaining imports from China will soon be hit with additional tariffs.

The declaration that China is a currency cheat was done without the coordination with other G7 countries or the IMF. Earlier this summer the IMF reported that the yuan rate is in line with fundamentals, though the US dollar is overvalued. IMF officials said on August 9th that they continue to hold this assessment.

What the Chinese did do on August 5th was to stop intervening to keep the yuan / dollar rate below 7. Downward market pressure on the Chinese currency did the rest. The People’s Bank of China, China’s central bank, subsequently intervened the next day to prevent market forces from pushing the yuan rate down even further. That, Chinese authorities fear, could trigger massive capital flight from the yuan, despite the extensive capital controls the government has implemented in the past several years to prevent that.

Meanwhile, the Chinese press reported that new purchases of US agricultural commodities had been stopped and that exemptions from Chinese retaliatory tariffs for US food imports were now suspended. This was in retaliation for President Trump’s announcement that on September 1st he would slap a 10% tariff on remaining imports from China not yet subjected to tariffs.

There is now widespread fear that a global currency war could break out.

Contradictory policy

There is a contradiction in the US administration’s policy, however. Economic theory explains that a country imposing tariffs on a trading partner will see its currency appreciate vis-a-vis that of the trading partner. So a falling yuan in relation to the dollar is hardly unexpected. Theory also explains that inbound foreign investment boosts a country’s currency. President Trump has been calling for more capital inflows and lauding the fact that the US attracts so much foreign capital. But encouraging production to shift from China and elsewhere to the US will also have a dollar strengthening effect. So the administration’s policy to weaken the dollar while simultaneously pursuing other policies that will strengthen it — doesn’t make much sense. For this and other reasons, a change in trade strategy is overdue.

Not that all is going well with China either – and we’re not just talking about Hong Kong. A headline in the Hong Kong based South China Morning Post says that “China’s economy is hurting and a trade deal can’t come a moment too soon for Beijing.” In the same vein, today’s Wall Street Journal reports that

President Trump’s tariffs and other sanctions are hitting China at a vulnerable moment….No one outside the Chinese government knows exactly what is happening in China. But even the latest report concedes that “economic conditions are still severe both at home and abroad” and that “the unbalanced and inadequate development at home is still acute.” If that’s the official line, the real story is certainly far worse.

WSJ, Aug. 12, 2019

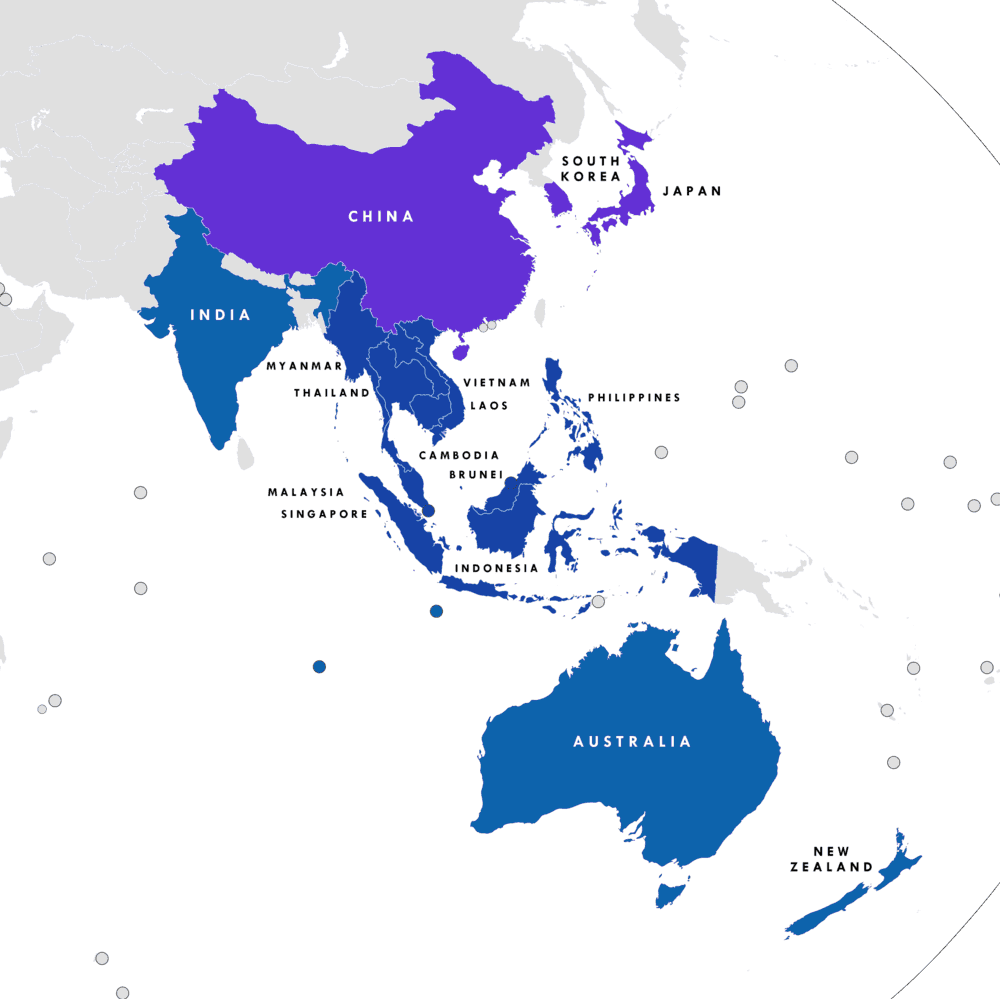

Meanwhile US trade talks with Japan and the UK look promising, but so do the Pacific region’s RCEP negotiations. RCEP, the Regional Comprehensive Economic Partnership, includes all the countries of eastern Asia including China, Japan, South Korea, India, and Australia – but not the US. RCEP’s anticipated conclusion by year end — while the US remains by its own choice outside the TPP (Trans-Pacific Partnership) – will be a further blow to US trade with the world’s most important rising trade area. It will also be a major boon to China.

Leave a Reply