The Biden tax program is to economics as the Biden green energy program is to science. by Richard Schulman The Biden tax programs can’t pay off the huge debt the administration is incurring. Corporate investment will suffer, as will workers’ income. The Biden administration’s American Jobs Plan (AJP) introduces multiple important changes to the US […]

Pandemic Trade War or Great GAFA Tax Heist?

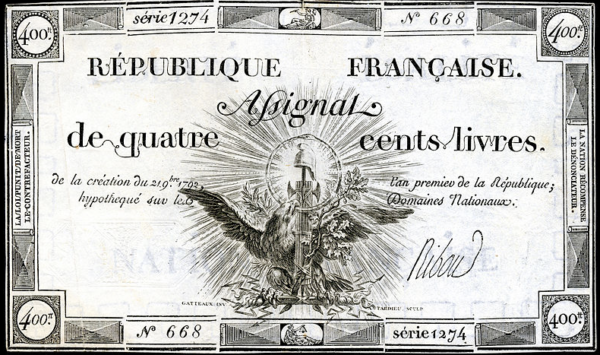

France can’t decide whether it wants to exemplify the reason and logic of René Descartes or the “bed-wetting” (President Charles DeGaulle’s term) of the May 1968 student rioters. The latter now seems the preference of the French government as exemplified by its unprincipled tax attack on four hugely successful US internet companies. The attack should […]

Progressives’ taxes mix bad economics with envy

by Richard Schulman Progressives are proposing four new taxes to finance their costly spending plans and to supposedly reduce inequality: A wealth tax (Senator Elizabeth Warren [D-MA]); An accelerated (Senator Ron Wyden [D-OR] or increased (former Vice-President Joe Biden) capital gains tax; A financial transaction tax (Representative Peter DeFazio [D-OR] and Senator Brian Schatz [D-HI]); […]

Why the Republican House is pushing “Tax Reform 2.0”

Republican legislators in the House of Representatives have announced that they will hold a vote before the end of September on a bill known as Tax Reform 2.0 (“TR2”). The bill would make permanent the politically popular provisions of the original tax bill (“Tax Reform 1.0”) passed by the Republican House and Senate and signed […]

Indexing capital gains taxes a good idea, but…

Support is growing among Republicans in Washington to shield capital gains from the ravages of inflation. President Trump’s economic adviser Larry Kudlow has written in support of the idea. So do Grover Norquist (President of Americans for Tax Reform), Senator Ted Cruz, and House Ways and Means chairman Kevin Brady. Rep. Devin Nunes of California […]