Commerce to get moderate Democrat Gina Raimondo as head. Trump admin pulls back on digital services tax retaliation but may rush, despite business opposition, last minute sanctions on Vietnam. China tech sanctions are levied by administration but NYSE fumbles. India is criticized at WTO for harmful tariff barriers and poor IP protection.

The weekly trade report with L.C.

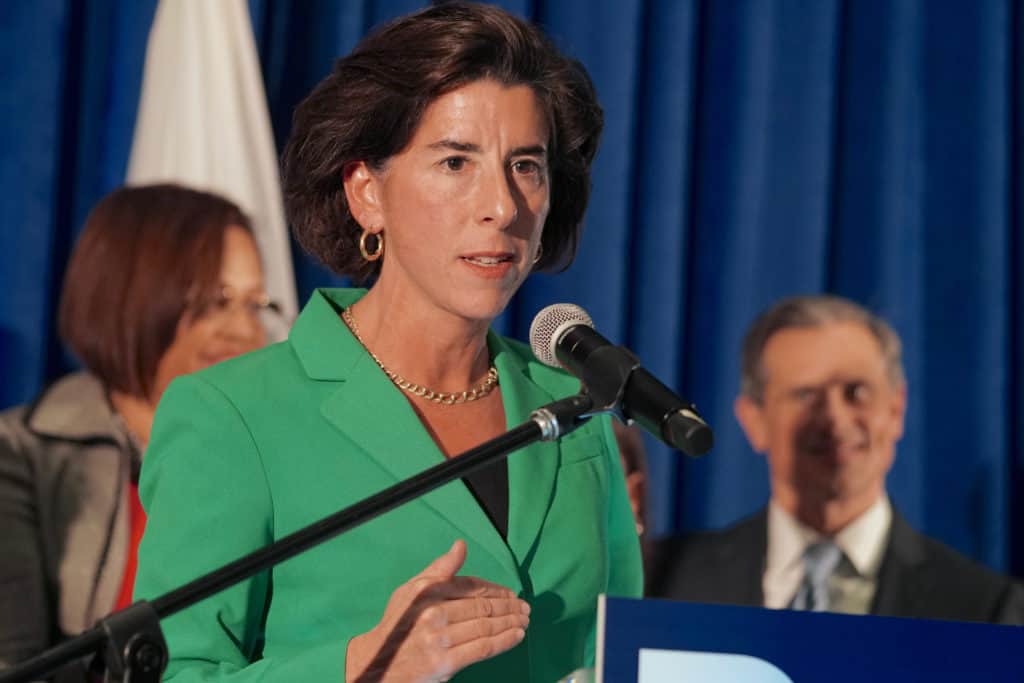

President-elect Biden finished appointing his cabinet secretaries with his January 6th announcement that he had chosen Gina Raimondo, currently the governor of Rhode Island, to be Secretary of Commerce, and Marty Walsh, now mayor of Boston, to be Secretary of Labor. Biden also announced his appointment of Don Graves to be Deputy Commerce Secretary and Isabel Guzman to be Small Business Administration administrator.

Raimondo has successfully governed her state as a moderate since taking office in 2015. She cut taxes and curbed excessive trade union demands. “At least two major unions, the public-sector giant AFSCME and the American Federation of Teachers, expressed forceful opposition to Ms. Raimondo with the Biden transition team,” the New York Times reports.

Raimondo has a background in the private sector, having led venture capital firms. She majored in economics at Harvard, took an unrelated PhD at Oxford, and then a law degree at Yale. That is seen as a solid background for boosting the competitiveness of US tech companies, especially vis-a-vis China. She will also be involved in decisions regarding technology competition. Commerce Department’s Bureau of Industry & Security maintains the Entity List of blacklisted foreign companies and deals with export controls.

Her department also takes the lead on export promotion — in which the State Department and USTR are also active — and in enforcing US trade laws. She will not, however, have an explicit role in developing trade policy. This is usually left up to the US Trade Representative and the president’s foreign policy and economic advisers.

Section 232 role

Regarding Section 232 (national security) trade issues, Commerce is the lead agency for conducting investigations and making recommendations to the president. Commerce is supposed to conduct non-political, fact-based Section 232 investigations and base its response to subsequent tariff exclusion requests solely on facts presented to it. Of course, politics often interferes anyway.

Raimondo will no doubt be in on conversations regarding what to do about the current 232 steel and aluminum tariffs that largely hit US allies, but the decision will likely be based on strategic considerations, with the weight of opinion likely to favor lifting them since the Biden team is stressing cooperating with allies to take on other challenges. The detrimental effects of the tariffs on the broad US economy and certain sectors (raising costs, provoking foreign retaliation, creating issues for the US at the WTO) are also likely to be considered. Raimondo and Treasury Secretary Yellen will both have a voice in these matters. However, the President-elect has already stated that he doesn’t expect to make any decisions regarding changes in trade policy quickly but only after consulting with trading partners and after dealing with the pandemic and economic recovery.

While Raimondo is seen as pro-business and a centrist, she may have some protectionist leanings. She herself has been bringing up the fact that her father, at age 57, was laid off from his manufacturing job when his factory was moved to China. Rhode Island is one of the northeast states that lost heavy industry and has strong labor unions. There is protectionist sentiment in the state.

Administration pulls back from DST retaliation

The Trump administration this week backed down from a planned escalation in the dispute over trading partners’ digital services taxes. It was set to slap retaliatory 25% tariffs on $3.1 billion of French exports on 1/6 (on handbags, soap, and cosmetic items), but suspended them at the last moment. It separately determined that three more countries have improperly imposed DSTs but was also suspending action in those cases. France, which has the support of the EU, had vowed to retaliate, to which the US was likely to counter-retaliate, and so the spat had been on the edge of getting out of control before the US pulled back.

The other seven countries currently undergoing Section 301 DST investigations are Austria, Brazil, Czech Republic, EU, Indonesia, Spain, UK. USTR said it “expects to announce the progress or completion of [these] DST investigations in the near future.”

Now it will be up to the Biden administration to figure out how to proceed. It really can’t just ignore the Section 301 investigations, undertaken under proper government procedures, and there will be domestic pressure from the tech giants and its allies to continue the fight against foreign taxes. These companies have, however, supported the OECD effort and say they object to individual countries imposing their own DST, creating uncertainty, confusion, and unfair treatment, but would accept taxes based on transparent and well-crafted international guidelines. That suggests that the incoming administration might deal with the issue by offering concessions to push the OECD talks to a conclusion. But if it retreats from the basic US position regarding scope of the DSTs, that could open it up to criticism that it isn’t sufficiently defending US interests.

Threatened tariffs against Vietnam

There is increasing opposition to the prospect that the Trump administration, in one of its last acts, will impose Section 301 tariffs on Vietnam. To do so, the USTR will have to finalize its investigations into Vietnam’s currency practices – its alleged deliberate undervaluation – and the alleged use of illegally harvested timber by its furniture-makers.

Despite how little time is left to carry out these activities, there is concern that the White House wants to complete the process. That would leave yet another messy trade situation for the Biden administration to deal with. Since the President-elect took a hard line against currency manipulation during his campaign, it would be difficult for him to simply reverse any actions taken against Vietnam after a US government investigation. But both countries are undergoing leadership changes. An unfriendly US action could undermine relations with the new regime that will take over in Hanoi later this month. Moreover, such a move would undercut the US call for manufacturers to relocate out of China. Vietnam is one of the few places that is relatively easy to move to. Sanctions against Vietnam would undercut US efforts to build a coalition of countries to oppose China’s growing clout in the region.

Business opposition

On January 7th, over 200 business associations and companies, many in the retail and apparel sectors, wrote to the president in opposition to slapping trade restrictions on Vietnam. They suggested using “more targeted tools.” They warned that “Responding with tariffs would undermine American global competitiveness and harm American businesses and consumers at a time when they can least afford it.”

Vietnam’s Timber & Forest Product Association said this week it will tighten its regulations to avoid importing illegally logged wood and will buy more US lumber in order to avoid the anticipated Section 301 25% tariffs that, it said, would devastate the sector. The US is the largest market for Vietnam’s wood products exports, but Vietnam is the second largest market for US lumber exports.

EOs against Chinese data, military companies

The White House issued an Executive Order addressing the issue of the national security threat from Chinese software applications that can compile data on Americans. The order, taking effect in 45 days, prohibits transactions with Alipay, CamScanner, QQ Wallet, SHAREit, Tencent QQ, VMate, WeChatPay, and WPS Office. It is similar to the administration’s efforts to block the US operations of TikTok and WeChat – efforts that have been blocked by courts, which could also be the fate of the latest prohibitions.

Meanwhile, the administration’s effort to block Chinese companies with military connections from trading shares in the US led to confusion this week at the New York Stock Exchange as the NYSE delisted, relisted, and then delisted in the space of several days several Chinese stocks. That confusion led to significant losses for some US investors, both individual and institutional.

Criticisms of India at its trade policy review

India underwent its seventh trade policy review at the WTO on January 6-8. The chairman of the Trade Policy Review Body said in his concluding remarks that “Members commended India on its strong economic growth during the review period, particularly in the services sector, allowing India to become one of the world’s largest economies.” But, reflecting WTO member comments, he said that “[c]oncerns were expressed about the high level of government intervention in the agriculture sector [and] urged India to reform its agricultural policies that continued to be based on significant levels of domestic and export support for key crops.”

The US was more blunt, stressing that India’s protectionist orientation was preventing its integration into international supply chains and its ability to attract investment that is leaving China. US WTO Amb. Dennis Shea said that “While we are encouraged by the Indian government’s efforts to attract additional foreign investment and its pursuit of a number of economic reforms, it is disappointing to see recent actions taken… that appear to chart a different course and actually restrict trade.” In “key services sectors,” Shea said, “India prohibits or significantly limits foreign participation…. Opening the retail, e-commerce, insurance, and other services sectors… including by allowing fully foreign-owned enterprises in these sectors, will… incentivize investment” and “contribute to improving supply chains.” India, he continued, “remains one of the world’s most challenging major economies with respect to protection and enforcement of IP.”

The EU similarly expressed concern “about the overall direction” of India’s trade policies and level of “willingness to integrate” into global supply chains. India, it said, has made “very little progress… in the last years on eliminating barriers to trade,” saying we are actually “witnessing an amplification of trade barriers” as well as inadequate enforcement of intellectual property rights.

L.C. reports on trade matters for business as well as Founders Broadsheet.

Leave a Reply