The Biden tax program is to economics as the Biden green energy program is to science.

by Richard Schulman

The Biden tax programs can’t pay off the huge debt the administration is incurring. Corporate investment will suffer, as will workers’ income. The Biden administration’s American Jobs Plan (AJP) introduces multiple important changes to the US tax code. The changes will negatively impact American business both here and abroad.

The progressive administration is justifying its tax increases on the claim that the rich are not paying their fair share, a four-Pinocchio falsehood.

The first principle of good tax policy is to not take from citizens more than needed by government for essential functions. The second principle is to minimize economic harm. Both principles are being violated by the administration in ways never seen before in US history. The $1.9 trillion American Rescue Plan Act (ARPA) was rushed through Congress by Democrats to conquer a pandemic already receding. It consisted mainly of monetary payoffs to favored constituencies, not money for essential government functions.

The follow-up $2 trillion American Jobs Plan (AJP), supposedly for urgently needed infrastructure, is mostly not about infrastructure but what the Wall Street Journal calls “the Green New Deal in disguise.” The small portion of the AJP that can legitimately be called infrastructure isn’t urgently needed or, arguably, needed at all. As a headline in RealClear Markets aptly puts it, “When Everything is Infrastructure, Nothing Is Infrastructure.”

This is of a piece with the administration’s new definition of “bipartisan” that excludes Republican senators and congressmen. Is former president Bill Clinton (“it depends on what the meaning of the word ‘is’ is”) now the White House semantics consultant?

Economic harm

The debt the administration is piling up with so much abandon is an unprecedented economic harm to the nation. “As of the fiscal 2020 fourth quarter,” the Journal writes, “more than half of the $1.6 trillion federal student loan balance was in forbearance.” Mrs. Warren “wants President Biden to cancel $50,000 in student debt per borrower by fiat. Her plan would disproportionately benefit millennials with advanced degrees. Thus has the pandemic become a pretext for a massive income transfer to privileged Americans.”

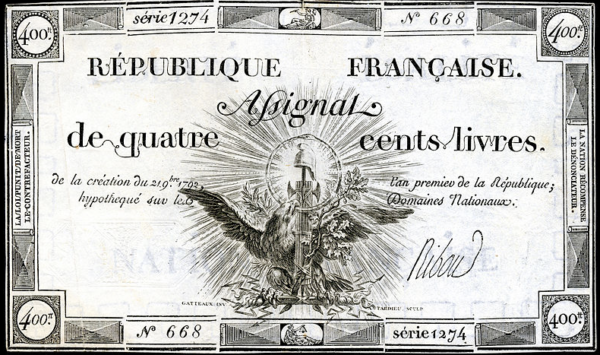

Debt concerns are being defined away in the name of Modern Monetary Theory, which, in essence, proposes to make the national debt disappear by printing American assignats with a “Federal Reserve Note” label replacing the earlier “République française.”

According to the Journal, “The U.S. budget deficit grew to a record $1.7 trillion in the first half of the fiscal year as a third round of stimulus payments sent federal spending soaring last month,”. This is debt a sane nation only takes on in a war for its survival. But it’s peacetime now, and the money is being spent on non-essential purposes rather than needed defense expenditures. Two heavily armed countries, Russia and China, are threatening a two-front war against an American regime they see squandering its wealth and power on crackpot green energy programs, welfare spending, and political boondoggles — this, in a country that under its new administration cannot even control its border.

Taxes to pay the debt

The debt being incurred will have to be paid down by present and future generations of middle-class taxpayers, many of whom already have considerable personal debts from mortgages, auto loans, and other borrowing. Those trillions of dollars in government expenditure and debt are funds that won’t be available to the private sector for productive investment. That means no increases in the standard of living – which depends on leaps in productivity — until the debt is paid down, if ever.

Repudiating debt through inflation

Rather than raise taxes sufficient to pay the debt, a more likely Democratic Party scenario will be to green light the Federal Reserve and Treasury to quietly repudiate the debt through inflation. This will ruin the dollar as the principal international reserve currency, weakening the US both economically and strategically. The inflation and associated monetary instability will reduce worldwide investment and trade and erode middle class savings and retirement income.

This is not futurological speculation: the inflation has already begun. Producer prices rose 1% in March. “Prices are up 4.2% in the last year, with goods prices up 7%,” the Journal reports in an editorial that leads off, “Congratulations to those who want higher inflation. You’ve got it.”

Reducing revenues by discouraging work

The Biden administration has also created perverse labor incentives. Many individuals are staying out of the labor force because they are receiving more payments from government by not working than they could get by returning to work. Meanwhile, Democrats are hailing ARPA’s child credit as the foot-in-the-door for a guaranteed income. That clearly won’t encourage work either.

Corporate tax increase

Which brings us to the economically harmful taxes the Biden administration is proposing, such as a corporate tax increase. The average federal-plus-state corporate tax rate is presently 27%. That’s already higher than the global average, which is 23.7%. As part of his infrastructure plan, the AJP, President Biden is proposing to raise the federal corporate tax from 21% to 28%, a 7% hike. That will bring the combined federal-state corporate tax rate in the US to 33.4%.

How will that affect the competitive position of US-based corporations? That 33.4% will be competing with Europe’s 19% and Asia’s 21.6% corporate tax rates. With so large a discrepancy, where do you suppose corporations, given a choice, will want to locate?

Contrary to populists of both the right and the left, “the neo-liberal, one-world uniparty” didn’t give US manufactures away to China. US tax policy did the job. The Biden corporate tax hike will make the problem even worse. Furthermore, increases in corporate taxes fall principally on the affected companies’ workers. How do you fix stupid?

A global minimum tax

But wait. Treasury Secretary Janet Yellen has a solution of sorts. Prevent international tax competition by having the OECD countries all agree on a 21% global corporate tax minimum to stop what she and her progressive colleagues call “a race to the bottom” — but the rest of us call “beneficial competition.” This would shut out Ireland, whose 12.5% corporate tax has attracted many US and international corporations to locate their headquarters there. A letter to the Journal made the relevant point that if Mrs. Yellen were a corporate executive making such a proposal, she’d be facing a jail sentence for price fixing and cartel promotion.

Capitulating to a digital services tax

As though this wasn’t bad enough, the US is also acceding at the OECD to pressures from countries like France and many others to tax the global revenues of major American software companies even though these companies have no physical presence in the countries demanding the payments. This violates a universal, long-standing norm of international tax law that specifies that taxes be assessed on a territorial principle, namely, that the country where a company’s headquarters are located gets to set the tax rate and be its exclusive tax collector. The OECD blackmail that the Biden administration is acceding to is in violation of numerous tax treaties and longstanding provisions of GATT and its World Trade Organization successor. But the administration isn’t even bothering to challenge the OECD tax heist in the relevant courts and administrative bodies.

GILTI increase and complexification

The Biden administration proposes to modify the TCJA’s Global Intangible Low-Tax Income provision (“GILTI”), which imposes a tax at least 13.125% on overseas profits arising from intangibles such as intellectual property held by offshore subsidiaries. Biden’s tax plan would increase that rate to a statutory 21% but effective rate of 26.25%. Worse, the Journal reports, the Biden crew want to compute the tax on a country by country basis. This “would introduce vast new complexity into the tax code…. Enforcement would be difficult because the volume of documentation would drown tax bureaucrats.” Such reporting “threatens to make overseas investment uneconomical.” It’s such “a terrible idea… that the Organization for Economic Cooperation and Development isn’t proposing anything like it in its global minimum-tax plan…. Why would Congress do to American companies what European governments won’t do to theirs?” the Journal editorial concludes. The administration also proposes to assess a 15% minimum tax on the book income of large corporations. Regarding this proposal the Tax Foundation writes:

A minimum tax on book income would introduce significant complexity into the corporate tax code while outsourcing key aspects of the corporate income tax to unelected decision-makers at the Financial Accounting Standards Board (FASB), who establish the standards for corporate book income. It may also undercut other proposed changes to the tax code, such as Biden’s proposed tax credit for onshoring of American supply chains.

Other planned taxes

The Biden administration and Treasury Secretary Janet Yellen are calling for income taxes, presently 37%, to be raised on Americans earning over $400,000; also, a capital gains tax hike from the present 20% (plus 3.8% surtax) to 39.6%. Raising punitive income taxes on the wealthy discourages earnings and investment in favor of inactivity and the purchase of unproductive luxury goods that will escape the tax collector.

Any capital gains tax is a bad idea: it taxes inflation caused by the government itself, is double taxation of income already taxed, and ties up capital in sub-optimal investments that, without the tax, would be going into more productive investment. That said, low capital gains taxes are preferable, because less harmful, than high ones. Unsurprisingly, the Biden administration not only proposes to go in the wrong direction but, by jumping from 20% to 39.6%, to do so big-time harm.

Senators from high state tax states like New York and New Jersey are threatening to withhold their votes on any bill that does not do away with the TCJA’s $10,000 limitation on deduction of state taxes paid (the SALT provision). If they succeed, this would be a tax giveaway to the affluent at the expense of the not-so-well-off. Their effort gives the lie to the Biden-Pelosi-Schumer narrative that Democratic tax proposals are solely intended to benefit the poor and middle class at the expense of the wealthy. As the Democrats’ top think tank, The Brookings Institution, wrote in 2017, “The SALT tax deduction is a handout to the rich. It should be eliminated not expanded.”

Retrospective

The Republican / Trump administration’s 2017 Tax Cuts and Jobs Act brought prosperity to the US until the pandemic from Communist China brought an end to that prosperity. The TCJA wasn’t perfect, but it was an improvement over previous tax law. Instead of improving the law and confining itself to needed expenditures, the Biden administration has embarked on an insane financial blowout centered around its scientifically bankrupt “net zero” green energy programs, to be semi-financed by tax changes that will damage the US, perhaps irreparably.

In opposition to the Democratic Party tax proposals, the Republican Party should counter with a plan to upgrade the TCJA by adopting the flat tax proposal of Robert Hall and Alvin Rabushka. If that had been done already in 2017, it would likely have been so popular that the Democrats would have faced strong majority opposition to their present proposed tax changes. The Hall-Rabushka flat tax would have made postcard tax filing possible for most Americans, eliminated multiple taxation of the same income, eliminated tax loopholes, and strongly encouraged work, savings, and investment.

4/22/2021: changed the “four-Pinocchio falsehood” link to a better one.

Must read. Great informative article. Explains what kind of a hell hole we’re headed down.

Want to live here for free. Biden promises money for all. And destruction of the environment. Green for all. Hallelujah