• Canadian Pacific and Kansas City Southern railroads agree to merge, forming “first USMCA railroad network”;

• HUGE proposal for Honduras, Guatemala, and El Salvador would provide home country jobs, relieve US border crisis;

• US farmers taking big export hit from US dropping out of Trans-Pacific Partnership;

• US Trade Representative Katherine Tai is first Biden nominee to receive unanimous vote, reflecting bipartisan protectionism;

• Section 232 steel and aluminum tariffs on allies haven’t been lifted, with result that retaliatory tariffs still punish bourbon and Harley-Davidson exports;

• Biden administration continuing Trump administration’s hostility to the World Trade Organization;

• Bipartisan majorities support industrial policy in select technologies but with misgivings as to Silicon Valley’s involvement.

The March 15-21, 2021 roundup of major trade developments, with L.C.

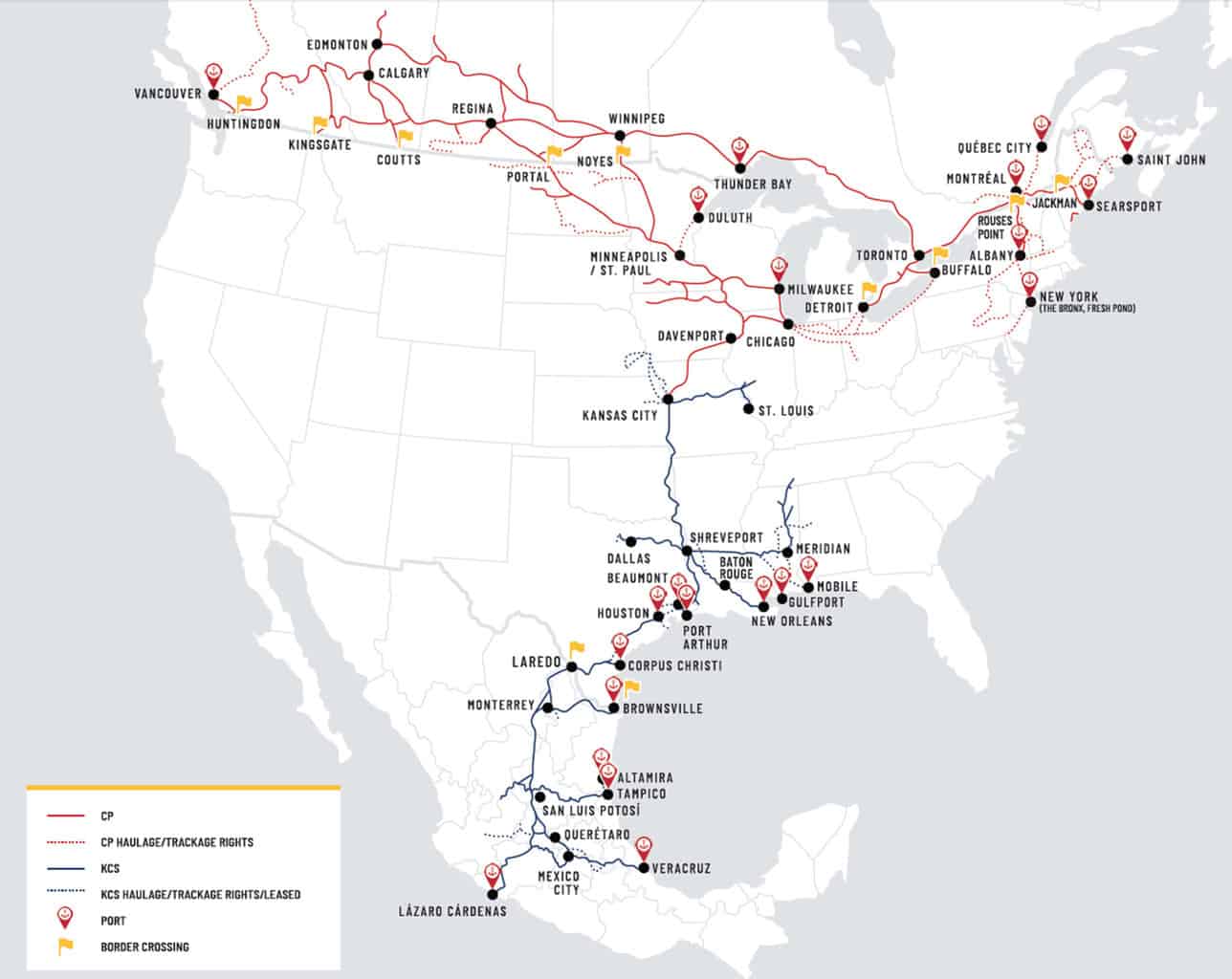

Canadian Pacific and Kansas City Southern railroads have agreed to merge. The combined entity will be named Canadian Pacific Kansas City (CPKC). It will be the first US-Mexico-Canada railroad. In a joint statement, CP and KCS said that

The new competition we will inject into the North American transportation market cannot happen soon enough, as the new USMCA (United States-Mexico-Canada) Trade Agreement among these three countries makes the efficient integration of the continent’s supply chains more important than ever before…. Grain, automotive, auto parts, energy, intermodal and other shippers will benefit from the increased efficiency and simplicity of the combined network… Following final regulatory approval, a single integrated rail system will connect premier ports on the U.S. Gulf, Atlantic and Pacific coasts with key overseas markets.

https://www.railwayage.com/freight/class-i/canadian-pacific-kansas-city-southern-will-merge-into-the-first-usmca-railroad-cpkc/

Central American prosperity would solve several problems

The USMCA needs to be expanded to Central America to create a truly continent-wide common market. In today’s Wall Street Journal, the paper’s veteran Latin American columnist Mary Anastasia O’Grady suggests an opening for moving in this direction:

The HUGE Business Council—an acronym for Honduras, U.S., Guatemala, El Salvador—aims to create one million jobs in the next three to five years by “near-shoring” supply chains that serve U.S. manufacturing. It also proposes to attract capital to build or rebuild things like roads, ports and airports and to bring U.S. natural gas to the region…. The idea dovetails beautifully with the vision of a commercially interconnected Central America, Mexico and U.S. Gulf Coast—via rail and shipping—laid out in a 2017 report on the Mexico-U.S. relationship from the Mexican Council for International Affairs.

O’Grady observes that HUGE could be a giant step toward lessening the crisis at the US border by providing jobs at home in Central America. Her column is sub-captioned, “Migrants are looking for an economy with jobs for them. If you build it, they will stay.” But she cautions that the protectionist US Jones Act is preventing Central America from being integrated with the nearby US Gulf Coast ports, among the other grievous damages it has been causing for over a century.

“America First” rejection of TPP is leading to America Last

Canada and Mexico — not to mention such close US allies as Japan and Australia — are members of the eleven member Trans-Pacific Partnership (CP-TPP). Former President Donald Trump rejected the CP-TPP as one of his first acts following inauguration. He did so in the name of “America First.” That act of rejection is now looking more like “America Last.” According to another piece in the Wall Street Journal “U.S. beef exports to Japan—the largest market for U.S. farmers—will be hit with a 38.5% tariff, up from the usual 25.8%, for 30 days. The volumes sold into Japan have exceeded the amounts set out in negotiations between the two countries. That isn’t a problem for farmers in New Zealand, Canada, or Australia—the main competition for U.S. farmers. Those countries are members of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership.” Their tax will fall to 9% by 2033.

The Biden administration so far seems determined to throw out all the positive accomplishments of the Trump administration (energy, deregulation, controlling the southern border, etc.) and embracing one of Trump’s bad policies, the out-of-control protectionism. This goes a long way toward explaining the bipartisan support for President Biden’s trade-related appointments.

Katherine Tai unanimous confirmation has its dark side

Thus, Katherine Tai, with no opposition, was confirmed by the Senate on March 17th, on a 98-0 vote, and sworn in as the country’s 19th US Trade Representative on March 18th. She was the first Biden cabinet nominee to be unanimously confirmed. We suspect that the bipartisan enthusiasm for USTR Tai and Biden administration trade policy will not be of long duration, especially among US trading partners and free trade supporters in the US. They will be disappointed to find that Tai and Biden will choose to subordinate trade expansion to “worker-oriented” job-protection, on-shoring, and environmental goals. The administration will brush off trade liberalization as an objective that the new president never prioritized and didn’t campaign on.

Founders Broadsheet was apparently the first to warn that Biden administration trade policy wouldn’t be that different from the Trump administration’s. But as of this week, it is beginning to have company. Although the US and EU did usefully negotiate a temporary suspension of mutually punishing tariffs in the Boeing-Airbus dispute, the Biden administration still hasn’t lifted the Section 232 steel and aluminum tariffs the Trump administration levied on allies in the dubious name of national defense. The European Union retaliated with tariffs on attention-getting American products such as bourbon whiskey and Harley-Davidson motorcycles. These are still punishing US manufacturers because the Biden administration has done nothing yet to lift the Trump steel and aluminum tariffs. “The EU is threatening to raise tariffs on American whiskeys to 50% by June 1 unless the two sides can negotiate a solution,” the Wall Street Journal reports.

Biden admin continues Trump admin’s WTO hostility

The Biden administration is also continuing the Trump administration’s hostility to the World Trade Organization. The US recently appealed a WTO panel ruling that sided with South Korea in its challenge to the US use of “Adverse Facts Available” (AFA) methodology in setting antidumping and countervailing duties. But the Appellate Body isn’t functioning because of US objections to it. This means the ruling is suspended indefinitely. The appeal of the WTO ruling, the first that the US lost since Biden became president, is seen as a signal that the Biden administration isn’t prioritizing cooperation within the WTO. Cooperation would have meant either accepting the WTO panel ruling or appointing Appellate Body judges so that its appeal could have been adjudicated.

In this case, Seoul challenged duties of up to 60% that the US had imposed on eight Korean exports – certain galvanized steel made by Hyundai Steel and POSCO and on large liquid dielectric power transformers made by Hyosung and Hyundai. The case is important to many US trading partners whose exports have also been hit with high unfair trade duties based on the same AFA methodology. Eleven countries are participating as amicus third parties in the case in sympathy with South Korea’s complaint, including Japan, the EU, and China.

In its challenge, Seoul argued that in using its “adverse facts available” methodology, the Commerce Department hadn’t adequately specified what information it wanted from the Korean companies, ignored some information they did provide, and unfairly rejected some that Commerce said arrived late. The WTO panel largely found these complaints to be valid. It ruled in the US favor on one charge: that Commerce has an “allegedly unwritten measure” or “rule” to choose the most “adverse” facts available in order to find the highest dumping margin whenever a company failed to provide requested data.

Bipartisan agreement on technology assistance

Senate Majority Leader Chuck Schumer has been working on a bill to provide assistance to domestic industries to maintain US technological dominance versus China. As he described his goals, they are to “enhance American competitiveness with China by investing in American innovation, American workers, and American manufacturing; invest in strategic partners and alliances: NATO, Southeast Asia, and India; and expose, curb, and end, once and for all, China’s predatory practices, which have hurt so many American jobs.”

While the importance of strengthening US technology isn’t questioned, some Republicans question the scope and expense of the package being developed. Some even question the possibly excessive government involvement in the economy and direction of private sector investment that parts of the package would entail. Senate Minority Leader Mitch McConnell also warned on March 17th that “The Democratic majority must resist the temptation to pile a long list of unrelated policy wishes into a big package and try to label it ‘China policy’.”

Silicon Valley technology role poses problem for industrial policy advocates

There are also members of both parties who have assumed a hostile stance toward the technology giants and may find it awkward to promote policies aimed at strengthening them. Amazon, Microsoft, Google, and Facebook are among the most advanced companies in developing such key technologies as AI, quantum computing, neural networks, and autonomous robotics. Antitrust actions, increased taxation, and new regulations that are being suggested to crimp their power would also crimp their ability to make new technological breakthroughs.

The package will have a particular immediate focus on two crucial sectors: semiconductors and 5G networks, but as Schumer said, “I want this bill to address America’s short-term and long-term plan to protect the semiconductor supply chain and to keep us number one in things like AI, 5G, quantum computing, biomedical research, storage.” Government resources as well as tax breaks and R&D tax credits will be key tools. The package will also include updates to export control and foreign investment policies (including transparency requirements), intellectual property protection, and market access and other aspects of the commercial relationship with China.

Semiconductor industry lobbying heavily

The Semiconductor Industry Association is pressing hard for direct government subsidies. Its CEO John Neuffer responded to a Wall Street Journal editorial questioning the use of subsidies to deal with the microchip shortage by writing, “Global competitors [have] passed the US as a location for chip manufacturing by… funding ambitious government incentives to lure semiconductor production to their shore,” so that now “only 12% of global manufacturing is… done in the US, down from 37% in 1990.”

There continue to be voices in the US that warn that adopting China-like industrial subsidization policies would be counterproductive and distortive, but they are likely to lose ground under the Biden administration, as they did under the Trump administration.

Revoke China’s Permanent Normal Trade Relations status?

An entirely separate bill – one focused on China but not likely to find its way into the Schumer package – was introduced on March 18th by three Republicans: Sens. Tom Cotton (R-AR), James Inhofe (R-OK), and Rick Scott (R-FL). The China Trade Relations Act would repeal the Permanent Normal Trade Relations (PNTR) status the US granted China when it joined the WTO twenty years ago. Instead, PNTR would revert back to the pre-2001 system in which China had to win Most Favored Nation status each year through approval by the president.

Against the view of most economists, the bill’s co-sponsors charge that granting China PNTR “supercharged the loss of American manufacturing jobs.” But the greatest loss of US manufacturing jobs came in recent decades even as manufacturing output soared, because workers were replaced by technology. Trying to get back to pre-2001 labor-intensive jobs would crimp US competitiveness, the opposite of what most China hawks think should be the US objective.

L.C. reports on trade matters for business as well as Founders Broadsheet.

Leave a Reply